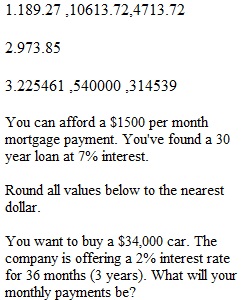

Q Question 1. Version 2*/2. Score: 2/3Expand Suppose you would like to buy a car that costs $9700. You have $3800 for a down payment, and you will finance the rest with a 3 year loan at 9.6% compounded monthly. Question 2. Version 1*/1. Score: 1/1 You want to buy a $34,000 car. The company is offering a 2% interest rate for 36 months (3 years). What will your monthly payments be? Message Message instructor Question 3. Version 1*/1. Score: 3/3 You can afford a $1500 per month mortgage payment. You've found a 30 year loan at 7% interest. Round all values below to the nearest dollar. How big of a loan can you afford? $ Correct How much total money will you pay the loan company? $ Correct How much of that money is interest? Question 4. Version 1*/1. Score: 3/3 You want to buy a $180,000 home. You plan to pay 20% as a down payment, and take out a 30 year loan for the rest. a) How much is the loan amount going to be? $ Correct b) What will your monthly payments be if the interest rate is 5%? $ Correct c) What will your monthly payments be if the interest rate is 6%? Message Message instructor Question 5. Version 2*/2. Score: 4/5Expand Suppose you want to buy a house that costs $225,000. You have $45,000 dollars for a down payment. The bank is offering two different mortgage options. • Option A: 25-year mortgage at 3.5%. • Option B: 25-year mortgage at 3.0% with two points. The cost of the points will be rolled into the mortgage. Compute the monthly payments for mortgage option A. (round to the nearest cent) $ Correct Compute the total cost of the home using mortgage option A. (round to the nearest dollar) $ Correct Compute the monthly payments for mortgage option B. (round to the nearest cent) $ Correct Compute the total cost of the home using mortgage option B. (round to the nearest dollar) $ Incorrect Assuming all other factors are the same, which mortgage option should you choose?

View Related Questions